Corporate Cloud Spending May See Strong Growth in 2022, Finds Bloomberg Intelligence

April 06, 2022

Bloomberg Digital Economy Index survey powered by Infosys sees more than 85% of enterprises plan to invest the same or greater amount into their tech spending

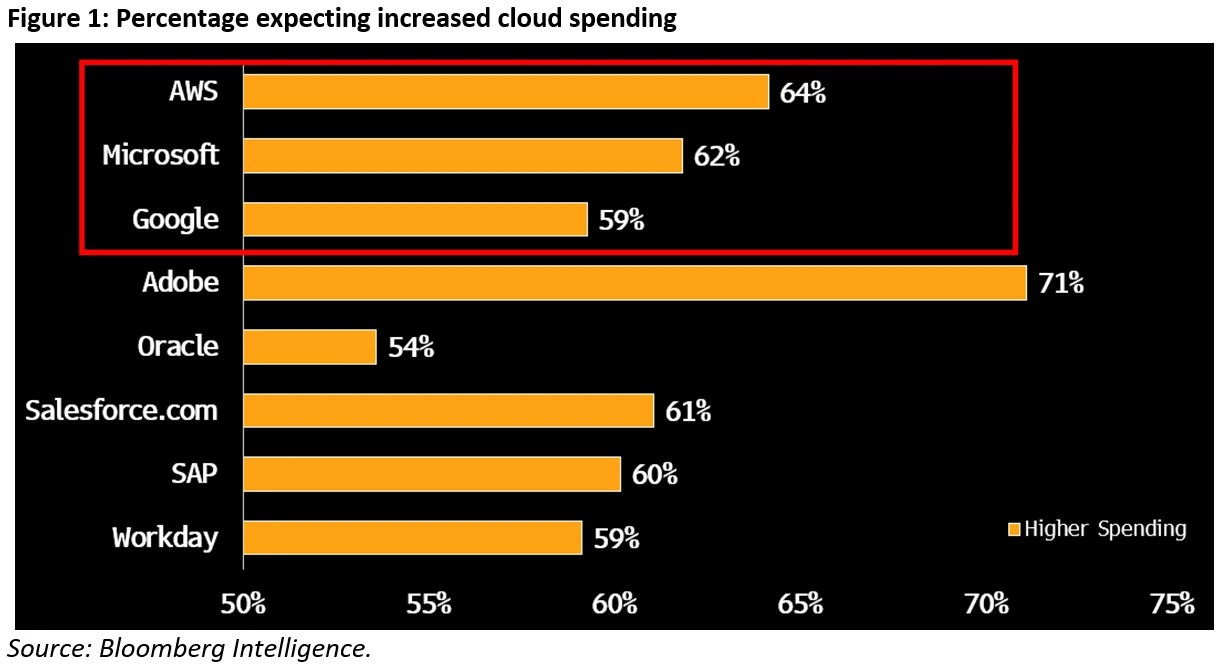

New York, April 06, 2022 – Corporate spending on cloud, analytics and security products, largely driven by necessary upgrades in technology brought about by the Covid-19 pandemic, is likely to balloon in 2022 to even higher levels than seen in 2021, according to a new report by Bloomberg Intelligence (BI) based on the findings from the first Bloomberg Digital Economy Index (DEI) survey powered by Infosys. The survey sees the top three cloud companies gain more market share in 2022 with 64% of the respondents looking to spend more with Amazon Web Services, followed by Microsoft (62%) and Google (59%).

The survey finds that 52% of respondents’ IT assets still reside on-premise despite the availability of cloud services in the last 20 years, creating the potential for robust demand for years to come. In the near-term a hybrid IT approach will likely be the most prevalent model, which companies such as Microsoft, and IBM (Red Hat) can take advantage of.

Of the companies surveyed 61% expect to see their technology spending to increase over the next year, while 72% of higher-spenders project to see more than a 9% increase in budgets compared to 2021. While much of this spending is dedicated to building out capacity for new technologies like cloud services, cybersecurity threats are a key factor in justifying the upgrading of IT systems.

Advances in cybersecurity rank highest among all emerging technologies considered as very important by respondents ahead of Artificial Intelligence and the metaverse. At the same time 68% of the survey respondents said that the tools currently available to them to address cybersecurity threats range from not adequate to moderately adequate. With the recent spike in cyberattacks globally, the report projects an even greater allocation of resources to security products and services going forward.

Anurag Rana, Senior Software and IT Services Analyst at Bloomberg Intelligence and lead author of the report said: “We’re seeing that companies’ increase in technology spending as a response to pandemic-necessitated upgrades is not going to slow down anytime soon. In fact, with the need for greater investment in IT infrastructure to build out new capacities like more efficient artificial intelligence and cloud services in addition to an increased understanding of cybersecurity risks, we’re expecting spending to continue to increase as companies’ recognize the critical importance of this investment.”

With current global enterprise tech spending being north of $1.5 trillion the DEI survey results show that global IT expenditure in 2022 could grow by mid-single digits despite an already unusually strong 2021. In IT services in particular, consulting-heavy firms like Accenture and IBM may gain more market share from offshore rivals and once again see faster growth.

The Bloomberg Digital Economy Index survey spans a diverse range of companies including 7% with annual revenue of $10 billion or more and captures trends in IT spending as well as their driving forces. Over 3,000 survey respondents from across Europe, North America and Asia Pacific with 25% of them at the C-Suite level and 82% of them overall with the ability to make technology-related decisions represent nine industries ranging from automobiles to technology. Bloomberg Media announced the collaboration with Infosys to create the index last November. The DEI survey will be conducted once per quarter.

The full Bloomberg Digital Economy Index survey powered by Infosys is available to Bloomberg Terminal subscribers who can access the report via {BI<GO>}.

Contact

Veronika Henze

Bloomberg Intelligence

+1-646-324-1596

vhenze@bloomberg.net

About Bloomberg Intelligence

Bloomberg Intelligence (BI) research delivers an independent perspective providing interactive data and investment research on over 2,000 companies, 135 industries and all global markets. Our team of 400 research professionals help our clients make decisions with confidence in the rapidly moving investment landscape. BI analysis is backed by live, transparent data from Bloomberg and 500 third-party data contributors that clients can use to refine and support their ideas. Bloomberg Intelligence is available exclusively on the Bloomberg Terminal and the Bloomberg Professional App. Visit us at https://www.bloomberg.com/professional/product/bloomberg-intelligence/ or request a demo.

About Bloomberg

Bloomberg, the global business and financial information and news leader, gives influential decision makers a critical edge by connecting them to a dynamic network of information, people and ideas. The company’s strength – delivering data, news and analytics through innovative technology, quickly and accurately – is at the core of the Bloomberg Terminal. Bloomberg’s enterprise solutions build on the company’s core strength: leveraging technology to allow customers to access, integrate, distribute and manage data and information across organizations more efficiently and effectively. For more information, visit Bloomberg.com/company or request a demo.

Disclaimer

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2022 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence.

Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.