Brent to Remain Below $70 a Barrel at the End of 2025, According to Bloomberg Intelligence Survey

April 02, 2025

Latest Bloomberg Intelligence Oil Survey finds that economic growth and Chinese demand are likely to be principal price drivers in the next 12 months

NEW YORK, APRIL 2, 2025 — A new survey from Bloomberg Intelligence (BI) finds that nearly 60% of survey participants expect Brent to sit below $70 a barrel at the end of 2025, in line with Bloomberg Intelligence’s fair-value model at $69, and global oil demand is not expected to peak before 2030.

The 2025 Oil Survey, which surveyed more than 100 energy-focused traders, strategists and economists from March 3-19, found that the threat of new US tariffs, the potential for expanding trade wars and President Donald Trump’s preference for cheaper gasoline, have skewed price risk to the downside. 32% of respondents predict Brent to be $70-$80 at the end of 2025. This outlook remains uncertain, but BI finds that OPEC+’s plan to increase production by 138,000 barrels a day in April, in a seemingly well-supplied market, presents another price overhang.

In the long term, 56% of survey respondents are predicting that Brent will remain below $70 a barrel at the end of 2026. Pressure from widening trade wars, a potential economic recession and higher supply from OPEC+ and non-group producers, will likely remain critical downside catalysts beyond 2025. While stricter US sanction enforcement on Iran, Russia and Venezuela could prove a significant upside catalyst, BI analysis suggests that prices are likely to stay below $85 a barrel even in a “maximum pressure” scenario.

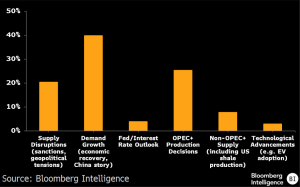

Salih Yilmaz, Senior Oil Analyst at Bloomberg Intelligence and the lead author of the survey said: “A large portion of survey respondents, 40%, predict that demand gains via an economic recovery and China are the most significant oil-price drivers over the next 12 months. It is clear that there is an incredible amount of uncertainty surrounding Brent prices, with sweeping US tariffs and retaliations continuing to pressure prices in the short-term.”

Most Significant Oil Catalyst in Next 12 Months?

The Trump administration is expected to lead to a decrease in oil prices in the next two years, according to a majority of respondents (73%), while 17% expect the administration to have no major effect. Threats of increased tariffs and the impact on global trade and oil demand — combined with a push for higher production by both OPEC+ and US producers — are likely driving the bearish view. BI finds that Trump’s preference for lower oil prices and cheaper gasoline at the pump is likely the dominant driver of these effects.

While there is increasing uncertainty about oil prices due to a plethora of US and global factors, the majority of respondents (86%) expect OPEC+ to maintain its alliance, with 62% anticipating no exits from the group following Angola’s departure. 47% believe that OPEC+ will continue to increase production in 2025, while only 5% foresee the group deepening cuts to support prices.

The full BI Oil Survey is available to Bloomberg Terminal subscribers who can access the report via {BI<GO>}.

Contact

Alaina Hay

Bloomberg Intelligence

ahay38@bloomberg.net

About Bloomberg Intelligence

Bloomberg Intelligence (BI) research delivers an independent perspective providing interactive data and investment research on over 2,000 companies, 135 industries and all global markets. Our team of over 400 research professionals help our clients make decisions with confidence in the rapidly moving investment landscape. BI analysis is backed by live, transparent data from Bloomberg and more than 600 third-party data contributors that clients can use to refine and support their ideas. Bloomberg Intelligence is available exclusively on the Bloomberg Terminal and the Bloomberg Professional App. Visit us at https://www.bloomberg.com/professional/product/bloomberg-intelligence/ or request a demo.

About Bloomberg

Bloomberg, the global business and financial information and news leader, gives influential decision makers a critical edge by connecting them to a dynamic network of information, people and ideas. The company’s strength – delivering data, news and analytics through innovative technology, quickly and accurately – is at the core of the Bloomberg Terminal. Bloomberg’s enterprise solutions build on the company’s core strength: leveraging technology to allow customers to access, integrate, distribute and manage data and information across organizations more efficiently and effectively. For more information, visit Bloomberg.com/company or request a demo.