APAC buyside leaders say major re-wiring of ESG thinking required to achieve ‘Alpha with Impact’

August 27, 2021

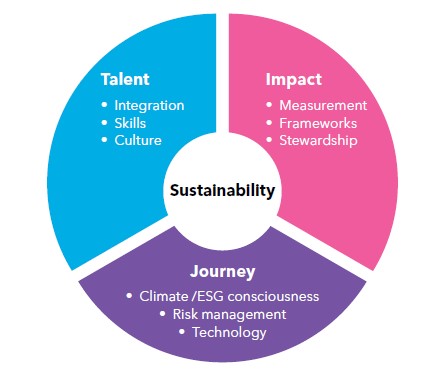

Report published by the Bloomberg Women’s Buy-side Network identifies talent, impact and journeys as important ‘North Stars’ for enabling successful sustainable investing operations

Hong Kong and Singapore – Bloomberg today released an environmental, social and governance (ESG) investing report developed by the Bloomberg Women’s Buy-side Network (BWBN) featuring views from more than a dozen senior investment leaders across BWBN’s five Asia chapters, identifying ESG Talent, ESG Impact and ESG Journeys as three major considerations for buy-side investors looking to deliver alpha while creating positive, long-term impact (‘Alpha with Impact’).

Buy-side leaders from firms including Nikko Asset Management, AIA Group, Allianz Global Investors, Multiple Alternate Asset Management, Kotak Mahindra Asset Management, HDFC Life, Schroders, PIMCO, BlackRock, Aioi Nissay Dowa Insurance, AllianceBernstein Japan, Bayview Asset Management, T. Rowe Price, Guardians of New Zealand Superannuation, Future Fund, QIC and HESTA contributed their views to this report.

The ability for firms to put sustainability at the core of everything is critical to maintaining an ESG investing ‘North Star’ – BWBN Executive Members

Achieving Alpha with Impact by integrating sustainability considerations at the center of a firm’s talent, impact and journey

As investors look to find a new balance between risk, reward and sustainability, buy-side firms are already re-orienting their own journeys towards a more socially responsible and resilient future. With COVID-19 and the harm climate change continues to bring, the appetite for creating a more sustainable world has never been as great or as urgent as today. The best firms have already incorporated a systematic approach to their ESG investments and develop innovative and impactful products for investors. And with ESG assets on track to exceed $53 trillion by 2025, representing more than a third of $140.5 trillion in projected total assets under management, the clock is ticking to ensure the industry can manage these assets in a robust and transparent manner.

Here are several key findings from the BWBN report:

Build a strong talent pipeline: As ESG consciousness continues to rise, the competition in talent has started to become a major issue. Many firms initially relied on ‘imported talent’ – ESG professionals who were hired from Europe or other developed economies; but the demand is changing. Companies are now looking to invest more in homegrown talent, looking within their home markets or business – driven in part by restrictions in movement and travel from the on-going pandemic. Furthermore, buy-side firms are even open to looking outside their traditional talent pool of finance to bring in diverse talent – even those who don’t possess traditional investment skills – to enhance their ESG thinking.

Understand the value of strategic interdependence thinking: In terms of skillsets, strategic interdependence thinking is a key element that is emerging, as there will always be a larger web of stakeholders, domains and scale. While collaboration has always been emphasized, there now is awareness that external ecosystem collaboration is going to be critical. People who can influence and lead change across domains and disciplines to co-create solutions internally and with investee companies will be extremely valuable.

Frameworks and disclosure are key: While the world is shifting towards a more ESG conscious future, firms are still concerned about the lack of a globally accepted consistent and comparable standard on ‘decision-useful’ sustainability disclosures. This will improve as global frameworks emerge in collaboration between private and public stakeholders. But the current lack of comparability and fragmentation in ESG rule interpretation is also creating ‘legal uncertainty’ for investment professionals. While these frameworks continue to develop, many buyside firms are already aligning their internal investment programs around core ESG investment principles, devising their own strategic parameters so they can invest transparently and with impact.

Risk management capabilities come to the fore: Firms have a duty to demonstrate both financial and non-financial outcomes underpinned by robust risk management practices. Failure to do this transparently and under robust governance procedures will risk the label of greenwashing. Materiality matters in sustainable investing, as firms need to demonstrate an integrated approach to long-term investment goals. In this environment, a firm can differentiate itself with its unique ESG risk management capabilities, potentially lifting its brand value.

Commenting on the report’s findings, Philippa Thompson, Head of Bloomberg’s Buy-Side Enterprise Sales, Asia Pacific, said, “ESG should be about more than just meeting evolving regulatory and customer needs. BWBN’s executive members feel that sustainable investing needs to be central to how all buyside firms operate and understand their investments in the future. And even though a true sustainable mindset requires a major re-wiring of how organizations approach their investments, the transformation is ultimately a necessary and rewarding journey.” She added, “Combined with reliable ESG data and robust technology workflows, these strategic ‘North Stars’ identified in the report will help buy-side leaders build a successful sustainable investing operation and deliver alpha with impact.”

Please click here to access the full report. To stay up to date with BWBN activities, please connect with us at https://www.linkedin.com/groups/10537205/.

About Bloomberg Women’s Buyside Network

The Bloomberg Women’s Buy-Side Network (BWBN) is an informal community for women in asset management in Asia. Launched in 2018 in Singapore, the network has expanded to local chapters in India, Japan, Australia, Brazil and Hong Kong and is helmed by some of the most influential buy-side leaders in the market. The BWBN convenes women in the buy side on global investment trends, serves to promote inclusion in the industry and, through active mentorship, educates the younger generation on the diversity of buy-side careers.

About Bloomberg

Bloomberg, the global business and financial information and news leader, gives influential decision makers a critical edge by connecting them to a dynamic network of information, people and ideas. The company’s strength – delivering data, news and analytics through innovative technology, quickly and accurately – is at the core of the Bloomberg Terminal. Bloomberg’s enterprise solutions build on the company’s core strength: leveraging technology to allow customers to access, integrate, distribute and manage data and information across organizations more efficiently and effectively. For more information, visit Bloomberg.com/company or request a demo.

Media Contact:

Bloomberg

Robert Koh

Email: rkoh22@bloomberg.net

Tel: (852) 2977 6600