60% of Enterprise Chief Information Officers Report Plans to Increase Spending on AI Inferencing Workloads with Microsoft, according to a Bloomberg Intelligence Survey

August 14, 2024

BI’s survey affirmed Nvidia’s GPU leadership, while Intel’s score improved amongst preferred CPU for AI servers

The results indicate that 70% of corporations surveyed are now using OpenAI, up from 41% in December

Cybersecurity dominated IT spending with 40% of CIO respondents ranking it as a number one priority, nearly double vs. December 2023

NEW YORK, AUGUST 14, 2024 — A new survey from Bloomberg Intelligence (BI) shows that Chief Information Officers (CIOs) are shifting their spending from servers, storage, and networking, to Large Language Model (LLM) deployment. The survey shows a clear preference for Microsoft in cloud deployment.

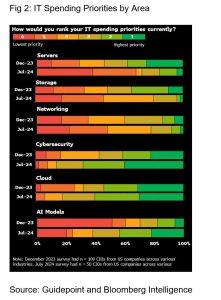

According to the survey results, AI investments became a larger priority for CIOs, ranking higher in planned spending allocation versus prior surveys. The growing AI emphasis suggests rising importance among CIOs to leverage this technology to remain competitive. Investments in foundational models, GPUs and cloud all ranked high in laying the foundation for future AI infrastructure. Nvidia’s GPU leadership was on display, with Intel’s CPU preference improving for AI servers.

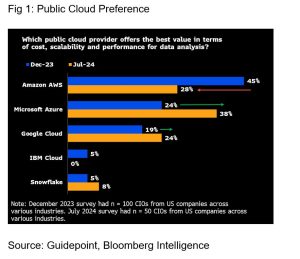

Now that enterprises have spent significant time in the research and development phase with their AI models, many of them are progressing from the proof-of-concept stage to deployment of their AI copilots. This has led to Microsoft gaining 14 percentage points since the December survey in hyperscale cloud value for data analysis, Google gaining 5 points and Amazon falling 17 points. Spending on AI models and workloads is likely to continue to increase over the next 12 months as more enterprises progress into larger-scale deployments.

Mandeep Singh, Senior Technology Analyst at Bloomberg Intelligence and the lead author of the report said: We’re witnessing a significant shift in CIO preferences as enterprise AIs move towards the deployment of their copilots, with 66% of respondents saying they are in the process of deployment compared to December’s 32%. This, coupled with newfound visibility in the need for robust cybersecurity spending in the wake of the CrowdStrike disruption, have significantly shifted the spending needs of CIOs even in the last six months.

Cybersecurity dominated IT spending in July with 40% of CIO respondents, nearly double the amount that responded in December 2023, citing it as their highest priority. The survey was conducted during the same time period as the CrowdStrike outage, when cybersecurity spending became increasingly non-discretionary due to the high risk of business disruption seen by the interruption. Servers, storage, and networking all were also deprioritized for CIOs since the last survey.

The full July 2024 CIO Survey will be available to Bloomberg Terminal subscribers who can access the report via {BI<GO>}.

Methodology

BI’s survey of 50 US-based CIOs was administered by Guidepoint from July 9-23, with questions regarding current and planned use of generative AI within their companies and preferred providers for the technology. The survey group came from companies of all sizes and across various sectors. The biggest portion, 24%, had 100-500 employees. Financial services, with 16% of respondents, was the largest sector in the survey, followed by telecommunications (14%) and health care (12%).

Contacts

Oktavia Catsaros

Bloomberg Intelligence

ocatsaros@bloomberg.net

About Bloomberg Intelligence

Bloomberg Intelligence (BI) research delivers an independent perspective providing interactive data and investment research on over 2,000 companies, 135 industries and all global markets. Our team of over 400 research professionals help our clients make decisions with confidence in the rapidly moving investment landscape. BI analysis is backed by live, transparent data from Bloomberg and more than 600 third-party data contributors that clients can use to refine and support their ideas. Bloomberg Intelligence is available exclusively on the Bloomberg Terminal and the Bloomberg Professional App. Visit us at https://www.bloomberg.com/professional/product/bloomberg-intelligence/ or request a demo.

Disclaimer

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence.

Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.

Make it happen here.