2015 Target Weights For The Bloomberg Commodity Index Announced

October 29, 2014

Brent Crude Oil makes the largest gain as trading volumes increase

New York — October 29, 2014 — Bloomberg today announced the composition and new target weights for 2015 for the Bloomberg Commodity Index (BCOM). Launched in 1998, BCOM, formerly the Dow Jones-UBS Commodity Index, is a highly liquid, diversified and transparent benchmark for the global commodities market. There will be no new contracts added or removed as a result of the annual reconstitution.

The target weights will be used to determine the Commodity Index Multipliers for 2015. These multipliers, computed once a year on the fourth business day in January, are factors used to express the percentage weights in U.S. dollar-denominated terms when calculating the index.

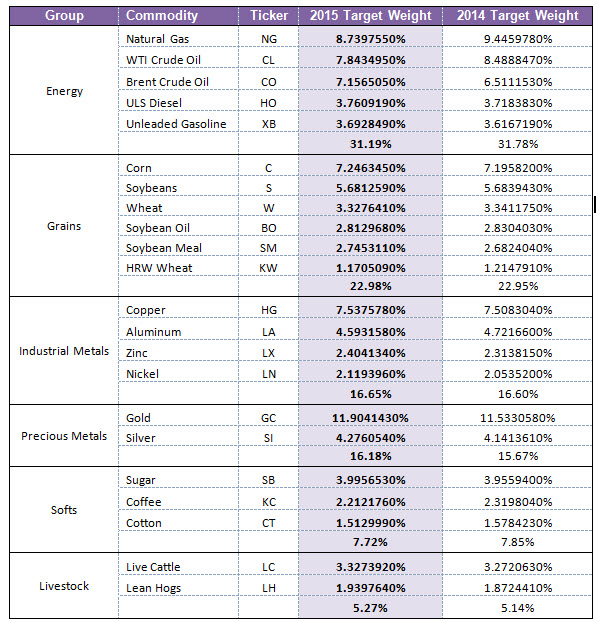

On an absolute basis, Brent Crude Oil has the largest weight increase in BCOM growing from 6.51% to 7.16%, while Natural Gas and WTI Crude Oil decreased the most from 9.45% to 8.74% and 8.49% to 7.84% respectively. Gold remains the highest weighted commodity in the index increasing its position from 11.5% to 11.9%.

Target weightings of all BCOM components for 2015, as well as their comparative weights in 2014, are provided in the table below:

The target weights are determined in accordance with the rules described in the Bloomberg Commodity Index Methodology. The index rules generally account for liquidity and production data in a 2:1 ratio and are subject to the following requirements for diversification:

- No single commodity may constitute over 15% of BCOM.

- No single commodity, together with its derivatives (e.g., WTI Crude Oil and Brent Crude Oil, together with ULS diesel and unleaded gas) may constitute more than 25% of BCOM.

- No group (e.g., Energy, Precious Metals) may constitute more than 33% of BCOM.

For a more in-depth breakdown of the annual rebalancing and methodology see this overview.

For additional information, terms and conditions and licensing opportunities, please visit www.bloombergindexes.com or type INDEX <GO> on the Bloomberg Professional service.

About Bloomberg Indexes

Bloomberg is an independent index provider for the fixed income, commodity and currency markets. Bloomberg meets the needs of investors and product issuers with transparent, accessible and solution-orientated benchmarks. The benchmarks are backed by Bloomberg’s technology, vast datasets and broad cross-platform distribution across institutional and media properties.

Media Contacts

• North America: Susan Doyle, sdoyle37@bloomberg.net, 212-617-7008

• Europe, Middle East & Africa: Natalie Harland, nharland1@bloomberg.net, 44-20-3525-8820

• Latin America: Pam Snook, pamsnook@bloomberg.net, 212-617-7652

• Asia: Belina Tan, belina.tan@bloomberg.net, 65-6231-3637