Bloomberg Professional Services

Bloomberg Tailors Toolkit to Empower Southbound Bond Connect Participation

September 22, 2025

Beijing – As Southbound Bond Connect expands its investor scope, Bloomberg has enhanced its suite of tools across data, research, and analytics to support onshore institutional investors’ cross-border access. These tools will enable them to quickly understand offshore bond markets, identify new opportunities and execute investment strategies. The Southbound Bond Connect is a mutual market access scheme that enables institutional investors in Mainland China to invest in offshore bonds.

According to the recently announced measures enhancing and expanding Bond Connect, the Southbound scheme’s investor scope now extends to non-bank financial institutions, such as securities firms, fund managers, insurers, and wealth management companies.

Jianying Zhang, Deputy General Manager at Ping An Asset Management, said: “Cross-border bond investment demands higher transparency, pricing efficiency, and risk management capabilities. With Bloomberg’s data and analytics tools, we can better capture the opportunities brought by the expansion of Southbound Bond Connect, make informed investment decisions, and optimize asset allocation for domestic insurance funds.”

Dahai Wang, Head of Greater China at Bloomberg, said: “The expansion of Southbound Bond Connect offers more onshore institutional investors new channels for offshore investment, helping optimize asset allocation and generate more attractive returns. In the long run, this will further enhance the global appeal of RMB assets. We look forward to supporting market participants as they make the most of our robust data, technology, and network to participate in cross-border investment.”

The suite of enhanced tools covers market research, security search and price discovery, and pricing analysis:

Market Research

- Bloomberg Hub {BHUB <GO>}: A launchpad integrating macro-economic analysis, money market, interest and FX rates, credit, bond search, global bond markets, and collaboration tools—helping analysts and traders access the data, insights, and tools they need on one click.

- Bloomberg Intelligence {BI STRTA <GO>}: Bloomberg Intelligence closely tracks the development of the China Dollar bond and Dim Sum bond markets, publishing thematic reports and monthly updates.

Security Search & Price Discovery

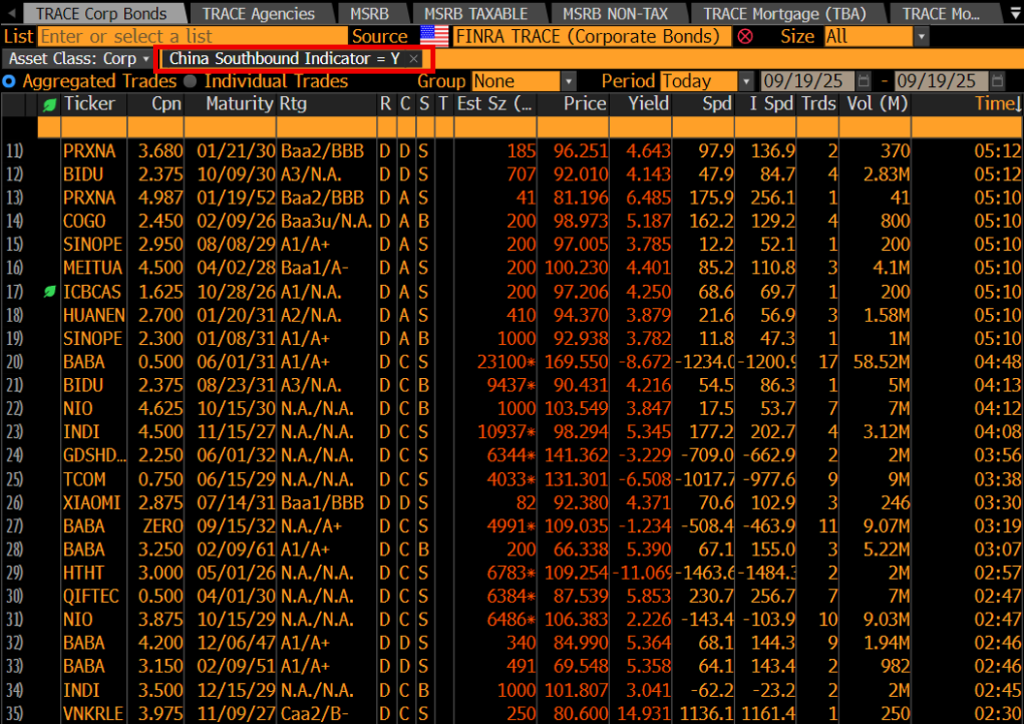

- Fixed Income Search {SRCH<GO>}: Bloomberg users can type “Southbound” in the search bar to select the “China Southbound Indicator” tag or directly type {SRCH SOUTHBOUND <GO>} to retrieve eligible securities for the Southbound Bond Connect scheme. Users can further filter the securities by yield, credit rating, maturity, and other criteria to inform investment strategies.

- Most Active Traded Bonds {MOSB<GO>}: By typing “Southbound” in the search bar, Bloomberg users can instantly access the most liquid bonds in the market and quickly identify market hotspots.

- New Issue Pipeline {PREL<GO>}: A “China Southbound Bond Connect” quick filter is available for investors to review new bond issues and syndicated loans.

Pricing Analysis

- Bloomberg Valuation (BVAL): Bloomberg Terminal users have access to Bloomberg’s evaluated pricing (BVAL) for bonds on Southbound Bond Connect. Additionally, as one of the leading data sources for Southbound Bond Connect, BVAL pricing data for eligible securities is also displayed on the China Foreign Exchange Trade System (CFETS) bond trading platform for onshore investors.

- Fixed Income Worksheet {FIW<GO>}: Users can create custom worksheets based on Southbound Bond Connect security search to analyze prices, relative value, and liquidity of selected bonds. Users can also share worksheets and collaborate on opportunity discovery and decision-making.

Southbound Bond Connect was launched in September 2021. Bloomberg worked closely with CFETS to roll out the Southbound Bond Connect solution[1] on day one, enabling offshore market makers to provide liquidity to onshore investors.

[1] The Bloomberg Southbound Bond Connect solution is provided to dealers in Hong Kong by Bloomberg Tradebook Hong Kong Limited.

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration.

For more information, visit Bloomberg.com/company.

Media Contact

Irene Gu, igu3@bloomberg.net, +852-2977-2111

Tingyu Liu, tliu554@bloomberg.net, +86-10-8642-0337