Despite Stagnant Unit Sales, Apple Loyalty and High-End Adoption May See Apple Revenue in the US Grow in FY24, Finds Bloomberg Intelligence

October 05, 2023

The third annual Bloomberg Intelligence iPhone survey of more than 1600 smartphone users found that only 62% of participants owned a phone that was released in the last three years

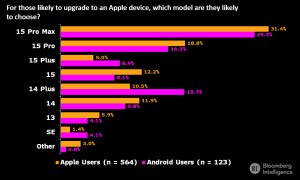

There is a high preference for consumers to adopt the highest-end Pro Max model, with prices 20% higher than the Pro, and 33% higher than the Plus

Apple loyalty sits at 93% of surveyed consumers, with Android lagging behind at only 80% loyalty rate

New York, October 5, 2023 —A new survey from Bloomberg Intelligence (BI) shows that despite fewer consumers needing new phones, high loyalty to Apple and an increasing shift towards purchasing the highest-end model in the iPhone line may yield revenue growth for the company in the US. Smartphones have quickly become an indispensable tool in both professional and public life, with the US market seeing mass adoption over the past couple decades. With the market maturing and adoption nearing universal levels, new sales have begun to stagnate.

The survey of more than 1600 smartphone users across diverse genders, incomes, ages and regions, found that only 62% of the participants owned phones that were released in the past three years, compared to 69% in 2022, suggesting that consumers are holding on to their phones for longer than ever before. This data suggests that Apple’s iPhone install base will grow at a modest 2% per year going forward because of changing consumer habits amidst pressure on purchasing power, compared to the past three-year average of 5%.

The outlook is not entirely negative for Apple amid this lengthening refresh cycle, as BI finds that Apple’s loyalty is incredibly high, with 93% of surveyed respondents saying they would continue to purchase Apple phones in the future, compared to Android’s 80%. This is key to Apple’s long-term market share gain, as a great portion of new unit sales will likely come from Android users switching to iPhone rather than market expansion. This, coupled with a shift of both Apple and Android consumers skewing towards purchasing the highest-end model, could mean that iPhone revenue in the US could still grow in fiscal 2024 even if unit shipments are slightly down.

Anurag Rana, Senior Technology Analyst at Bloomberg Intelligence and the lead author of the report said: “We’re witnessing a significant shift in consumer smartphone habits as pressures like inflation and reduced purchasing power lead consumers to hold onto their phones for longer before upgrading. Companies like Apple would do well to continue to grow their highest-end product offerings and attract Android users to meet shifting demand and continue to see revenue increases even as the refresh cycle lengthens.”

Figure One: Fifth of Android Users Could Switch to Apple

While iPhone revenue may grow in fiscal 2024, the survey finds that the Apple TV product and service are both losing popularity, with only 14.5% of iOS users owning the Apple TV product, compared to 22% last year. This decline can be attributed to lower-priced alternatives such as Roku and Fire TV as well as the growing popularity of smart TVs. This product decline is accompanied by a decrease in the usage of the AppleTV+ service, which fell to 26.6% in 2023 from 31.7% — likely due to price increases, lack of content, and an overall slowdown in the industry.

The full 2023 US Apple iPhone Survey will be available to Bloomberg Terminal subscribers who can access the report via {BI<GO>}.

Contact

Oktavia Catsaros

Bloomberg Intelligence

ocatsaros@bloomberg.net

About Bloomberg Intelligence

Bloomberg Intelligence (BI) research delivers an independent perspective providing interactive data and investment research on over 2,000 companies, 135 industries and all global markets. Our team of over 400 research professionals help our clients make decisions with confidence in the rapidly moving investment landscape. BI analysis is backed by live, transparent data from Bloomberg and more than 600 third-party data contributors that clients can use to refine and support their ideas. Bloomberg Intelligence is available exclusively on the Bloomberg Terminal and the Bloomberg Professional App. Visit us at https://www.bloomberg.com/professional/product/bloomberg-intelligence/ or request a demo.

Disclaimer

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2023 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence.

Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.

Make it happen here.