U.S. Has Potential to Reduce Chinese Technology Supply Chain Dependency by 20-40% by 2030, Finds Bloomberg Intelligence

September 29, 2022

With heavy reliance on chip manufacturing, the detangling of the U.S.-China technology supply chain is a large challenge, but not an impossible one

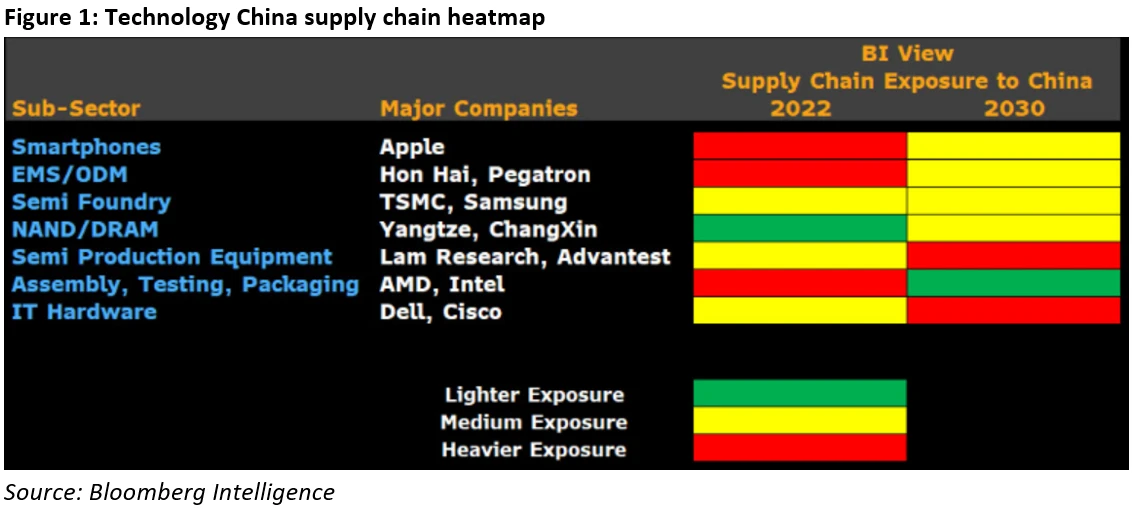

New York, September 29 2022 — The United States’ dependency on Chinese technology supply chains could be reduced by up to 40% by 2030 in key segments, according to a new report from Bloomberg Intelligence (BI). If the U.S. were to move to lessen its supply chain from China, it could reduce its dependency by at least 20% in a moderate scenario. China’s dominance in chip manufacturing as well as the broader electronics manufacturing services sector (EMS) are marked obstacles for a more significant reduction in Chinese supply chain dominance.

Growing geopolitical tensions between the U.S. and China, continuing pandemic-driven lockdowns in China, and unexpected power curbs that cause significant delays in the production of Chinese-manufactured goods, all contribute to more companies embracing the concept of “China Plus One” – meaning more companies are adding production capacities outside of China. China’s manufacturing stake in certain key sectors such as smartphone manufacturing has grown to encompass 70% of the global share and almost 50% of global smartphone shipments, creating an especially daunting challenge for any company looking to diversify their supply chains away from the country.

“Decoupling supply chains can be difficult,” said Steven Tseng, senior technology analyst at Bloomberg Intelligence. “The dominance of Chinese companies on smartphone, chip, and the wider electronics manufacturing services sector poses a particular challenge should the U.S. take action to reduce its dependence on Chinese supply chains. Even our most aggressive scenario shows only a 40% reduction by the end of this decade. With U.S. market juggernauts like Apple relying almost exclusively on China for its manufacturing and assembly, the path to decoupling of the two countries’ supply chains would be long and arduous.”

Apple, for example – the largest provider of smartphones in the U.S. – currently relies on China for the assembly of 98% of iPhones. Even if Apple chose to commit to reduce its dependency on Chinese supply chains, BI’s analysis finds that only 10% of production capacity could be transitioned out of China by 2030 — with even the most aggressive projections capping at 20%. Hurdles such as high infrastructure requirements, the slow delivery of extreme ultraviolet lithography systems critical to chip development, and a lack of local U.S.-based supply chain support all lay the groundwork for a challenging reduction scenario.

The burden of combating these significant obstacles likely relies on the actions of the major companies that have initially built their infrastructure with China’s supply in mind. Incentives such as financial subsidies, partial shareholding, and multi-year supply agreements could provide a pathway to encourage other countries to take on some of the manufacturing needs of the U.S.

An executive summary of the U.S.-China Technology Supply-Chain report is available via the following link. Bloomberg Terminal subscribers can access the full report via {BI<GO>}.

Contact

Veronika Henze

Bloomberg Intelligence

+1-646-324-1596

vhenze@bloomberg.net

About Bloomberg Intelligence

Bloomberg Intelligence (BI) research delivers an independent perspective providing interactive data and research across industries and global markets, plus insights into company fundamentals. The BI, team of 400 research professionals is here to help clients make more informed decisions in the rapidly moving investment landscape. BI’s coverage spans all major global markets, more than 135 industries and 2,000 companies, while considering multiple strategic, equity and credit perspectives. In addition, Bl has dedicated teams focused on analyzing the impact of government policy, litigation and ESG.

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.

Disclaimer

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2022 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence.

Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.