Volkswagen to Overtake Tesla’s Battery Electric Vehicle Sales Crown by 2024, Finds Bloomberg Intelligence

June 14, 2022

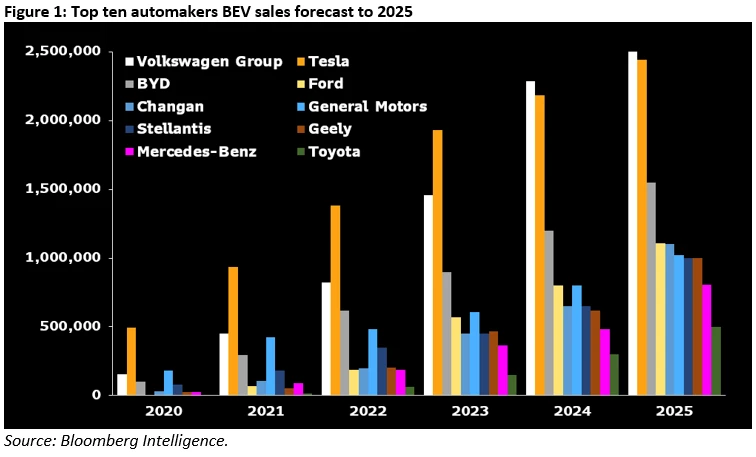

Tesla to retain global sales top spot for at least another year, before Volkswagen – already leading in Europe – likely overtakes it as early as 2024

New York, June 14, 2022 – Tesla is likely to retain its global number one battery electric vehicle (BEV) sales spot for at least another 18 months as legacy automakers struggle to sell a meaningful share of BEVs in 2022 and 2023 according to a new major report on the global EV sector by research firm Bloomberg Intelligence (BI).

The report entitled ‘Battery Electric Vehicles Report – Automakers Race to the Top’ finds that the profit incentive to catch up with Tesla is lacking for most traditional marques in the short term amid rising battery costs and a lack of scale, except for Volkswagen. The German automaker is on track to overtake Tesla’s BEV volume in 2024 as global BEV demand is set to more than double out to 2025. BI’s analysis shows China’s BYD ranking third for BEV sales globally in 2025 followed by a glut of legacy automakers languishing around the one million annual BEV sales mark. It is not until later in the decade that US and Japanese automakers will be serious challengers for a top 3 spot.

In a bid to challenge Tesla’s $686 billion dollar market cap – which is almost double that of all US and EU legacy automakers combined – the report highlights that legacy automakers are unlikely to succeed in divesting BEV-related assets that are intertwined with their combustion operations and whose cash flows are paying for the transition. Volkswagen is the exception and is on track to launch an IPO of its Porsche brand in 4Q. Given the company’s potential 30% BEV sales mix in 2023 and about 45% in 2025, it is significantly ahead of peers and could attract a luxury based 85 billion euros valuation for the IPO and, possibly, an even higher tech-oriented valuation, according to the report.

“Looking ahead, automakers in Europe, China and elsewhere will continue to challenge Tesla via an impending wave of new models, though profit incentives are limited amid rising battery costs and a lack of scale. That may change in 2025-26 as more brands achieve critical mass on new-generation models with proprietary software. There are a number of challenging external factors to consider and bold BEV ambitions have done little to prevent crisis-level valuation multiples, stoked by recession fears, rising interest rates, supply-chain constraints and inflation,” said Michael Dean, Senior European Automotive Industry Analyst at Bloomberg Intelligence.

Battery prices remain critical to the cost competitiveness of BEVs and Volkswagen is investing up to EUR30 billion in the supply chain, including the opening of six new battery-cell plants in Europe by 2030. Swedish battery developer Northvolt starts production on premium cells for it in 2023, notes BI, while Audi’s midsize Q4 BEV SUV already has a similar margin to its internal-combustion-engine counterpart, the Q3.

“China’s carrot-and-stick approach to stoking EV sales could push battery-electrics to account for 25% of all passenger vehicle purchases by 2025. Sales in China have surged since the launch of the country’s new energy vehicle credit program despite erratic component supply,” said Steve Man, Senior China Automotive Industry Analyst at Bloomberg Intelligence.

Volkswagen, BMW and other foreign brands’ sales in China may come at the expense of pricing and profitability, having ceded first-mover advantage to Tesla and local makers. BYD, Nio, Xpeng and other local firms are rapidly closing the technology and branding gaps, wooing consumers not only with driving range and power, but also lower prices, luxury trim and even virtual-reality entertainment.

“Ford is set to spin the electric vehicle narrative away from Tesla with the F-150 Lightning getting an early – and year-long – jump on the competition and making Ford the first automaker to ramp up production of a full-size battery-only pickup truck. General Motors and Tesla won’t compete in the space before 2023 and Rivian’s small scale makes it unthreatening,” according to Kevin Tynan, Senior North American Automotive Industry Analysts at Bloomberg Intelligence.

“Japanese automakers are crafting their electrified vehicle strategies with comprehensive offerings to meet the requirements of different markets. The industry is poised to accelerate electrification efforts, leveraging expertise gained from hybrids, which now dominate their domestic market, to compete, including in battery electric vehicles,” said Tatsuo Yoshida, Senior Japanese Automotive Industry Analyst at Bloomberg Intelligence.

The full report “BI Battery Electric Vehicles Report – Automakers Race to the Top” is available via the following link. The BI report specifically forecasts automaker’s battery electric vehicles sales up to 2025. For a longer-term view on electric vehicles up to 2050, please refer to BloombergNEF’s latest Long-Term Electric Vehicle Outlook 2022.

Contact

Veronika Henze

Bloomberg Intelligence

+1-646-324-1596

vhenze@bloomberg.net

About Bloomberg Intelligence

Bloomberg Intelligence (BI) research delivers an independent perspective providing interactive data and investment research on over 2,000 companies, 135 industries and all global markets. Our team of 400 research professionals help our clients make decisions with confidence in the rapidly moving investment landscape. BI analysis is backed by live, transparent data from Bloomberg and 500 third-party data contributors that clients can use to refine and support their ideas. Bloomberg Intelligence is available exclusively on the Bloomberg Terminal and the Bloomberg Professional App. Visit us at https://www.bloomberg.com/professional/product/bloomberg-intelligence/ or request a demo.

About Bloomberg

Bloomberg, the global business and financial information and news leader, gives influential decision makers a critical edge by connecting them to a dynamic network of information, people and ideas. The company’s strength – delivering data, news and analytics through innovative technology, quickly and accurately – is at the core of the Bloomberg Terminal. Bloomberg’s enterprise solutions build on the company’s core strength: leveraging technology to allow customers to access, integrate, distribute and manage data and information across organizations more efficiently and effectively. For more information, visit Bloomberg.com/company or request a demo.

Disclaimer

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2022 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence.

Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.